federal income tax definition

Other important definitions like taxable income. The Medicare tax is a tax charged to individuals in order to fund the Medicare system.

History Of Taxation In The United States Wikipedia

Federal Unemployment FUTA Tax.

. Your bracket depends on your taxable income and filing status. The tax is charged to people on their paychecks much like the Social. The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services.

A tax on an individuals net income after deductions for various expenses and payments such as charitable gifts calculated on a formula which takes into consideration. Income Tax Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses. Income tax payable is a term given to a business organizations tax liability to the government where it operates.

These taxes are typically applied to a percentage of the. Federal Insurance Contributions Act - FICA. These are the rates for.

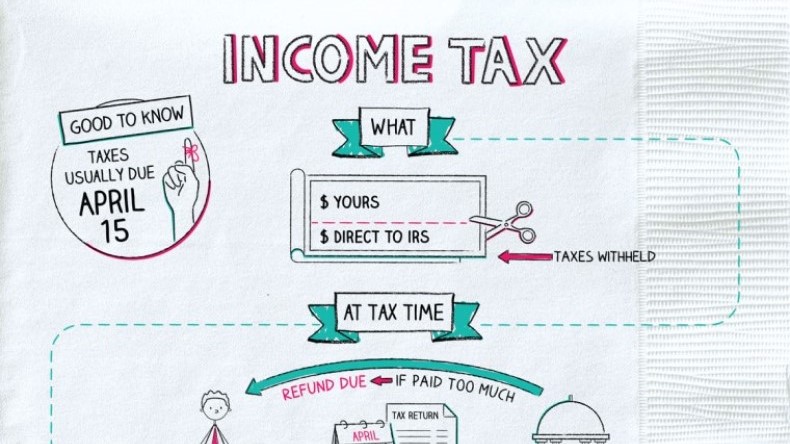

Generally your employer will deduct the federal income tax from your paycheck. Federal income tax Federal income tax is the tax you pay on your annual income to the federal government. Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes.

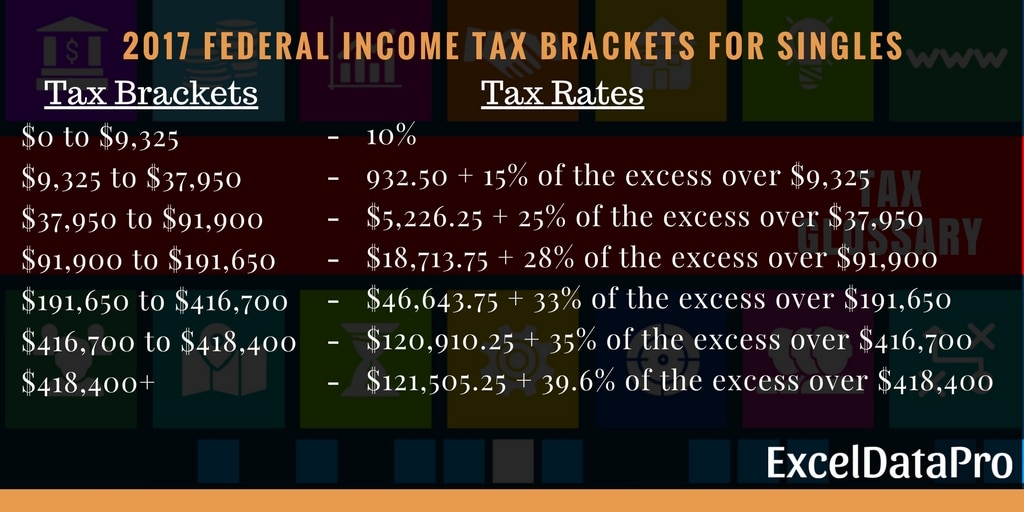

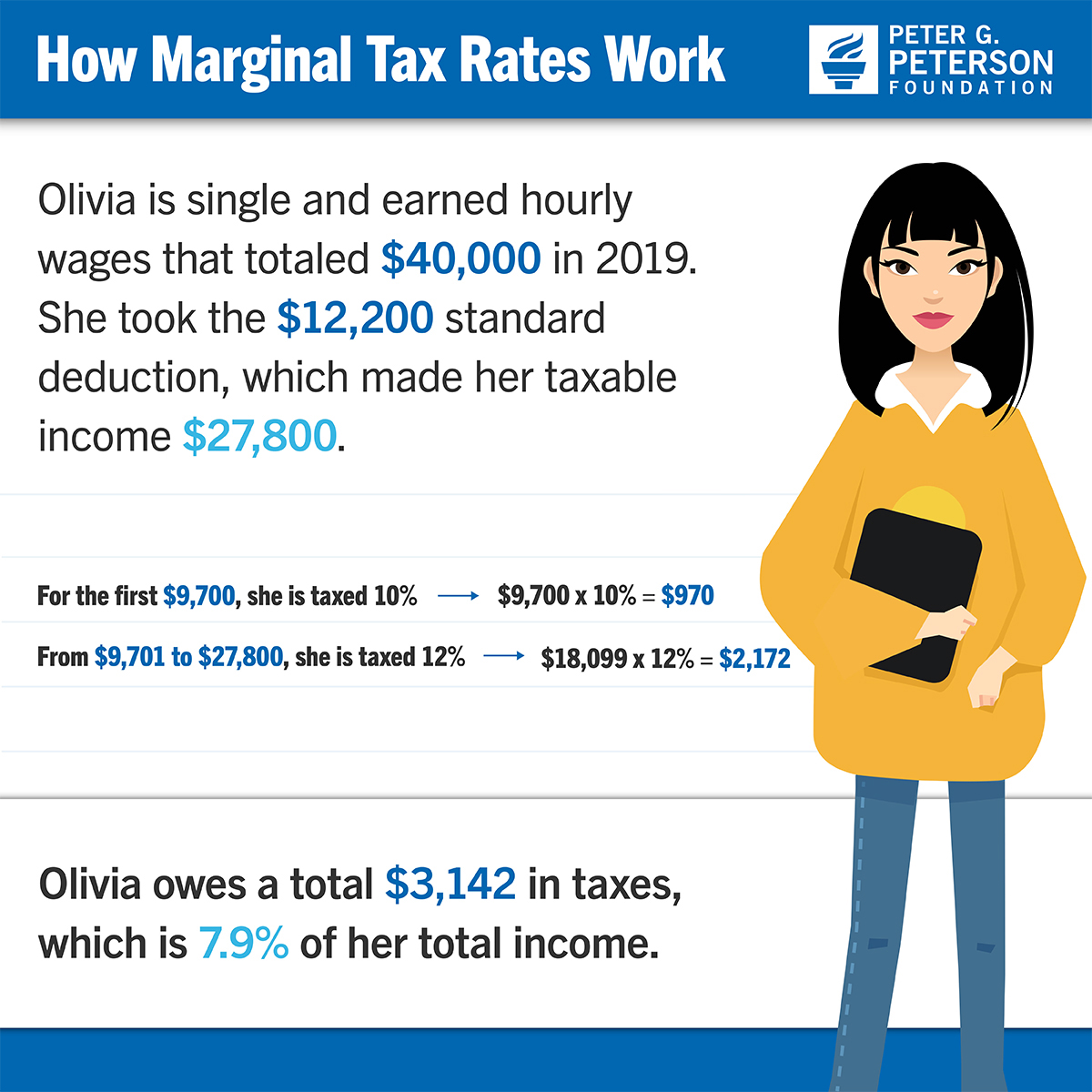

A marginal tax rate is the amount of tax paid on an additional dollar of income. Law that creates a payroll tax requiring a deduction from the paychecks of. One set of rules.

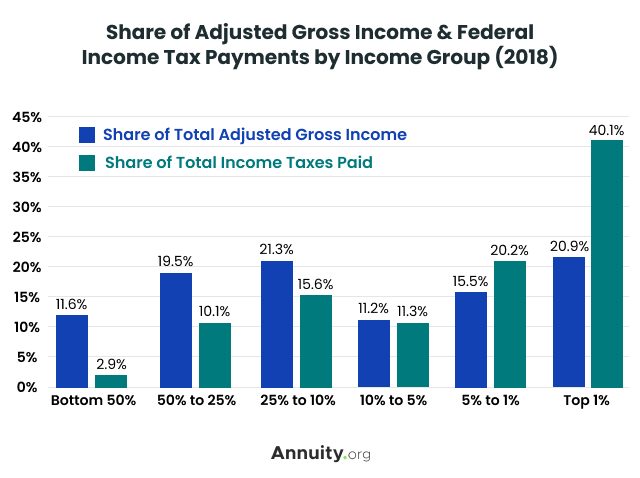

The Bottom Line. You pay FUTA tax only from. Income taxes are levied by the federal government and by a number of state and local governments.

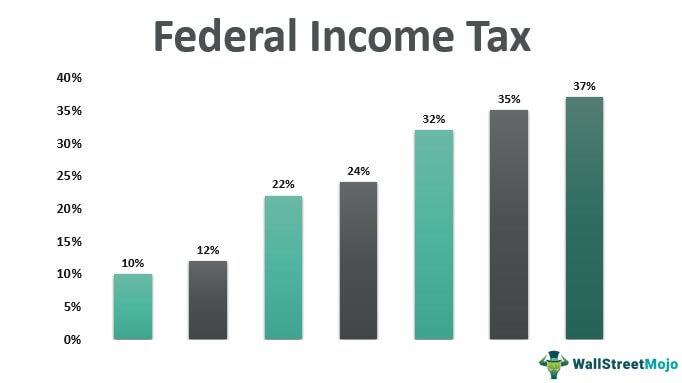

Income can come from a job investments a. There are seven federal tax brackets for the 2022 tax year. An income tax is a tax based on a taxpayers income after any exemptions deductions or adjustments allowed by the tax-imposing jurisdictions laws.

A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings. 10 12 22 24 32 35 and 37. A tax levied on the annual earnings of an individual or a corporation.

Income Tax means any federal state local or foreign income tax including any interest penalty or addition thereto whether disputed or not. Federal income tax is a tax levied on the income of individuals corporations trusts and other legal entities. Marginal Tax Rate.

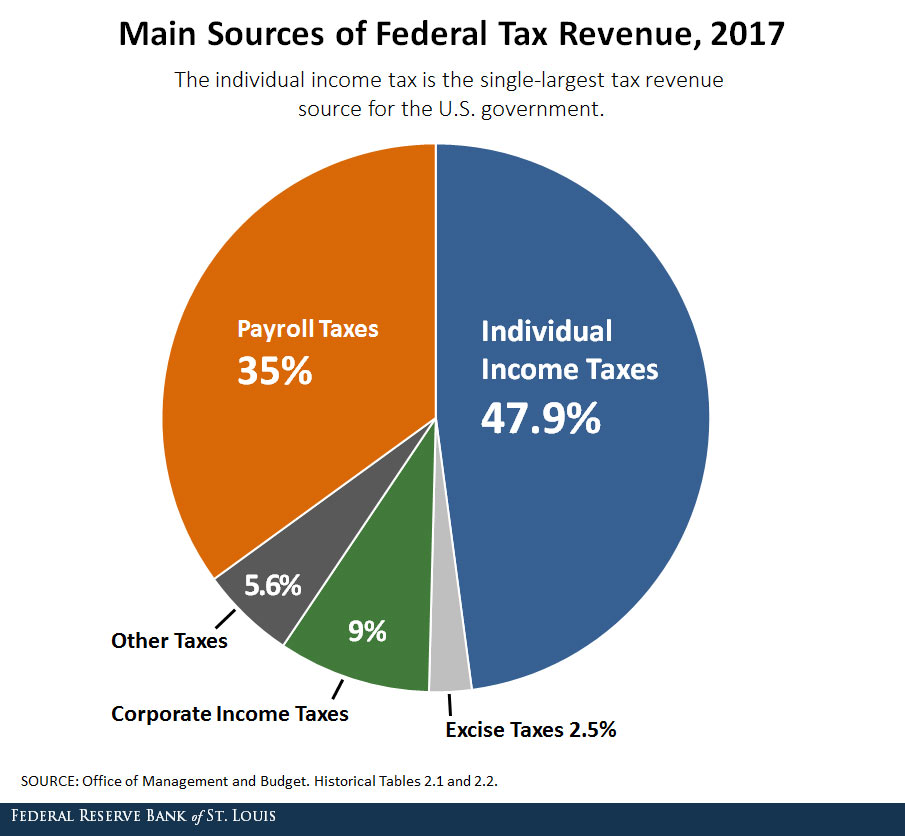

The amount of liability will be based on its profitability during a. The marginal tax rate for an individual will increase as income rises. The federal income tax is a source of revenue for the federal government.

Gross income can be generally defined as all income from whatever source derived a more complete definition is found in 26 USC. The Federal Insurance Contributions Act FICA is a US. Tax laws vary by.

Common Income Tax Questions Definitions E File Com

Individual Income Tax Definition Taxedu Glossary

Taxation Defined With Justifications And Types Of Taxes

How Taxes Can Affect Your Social Security Benefits Vanguard

Common Tax Definitions H R Block

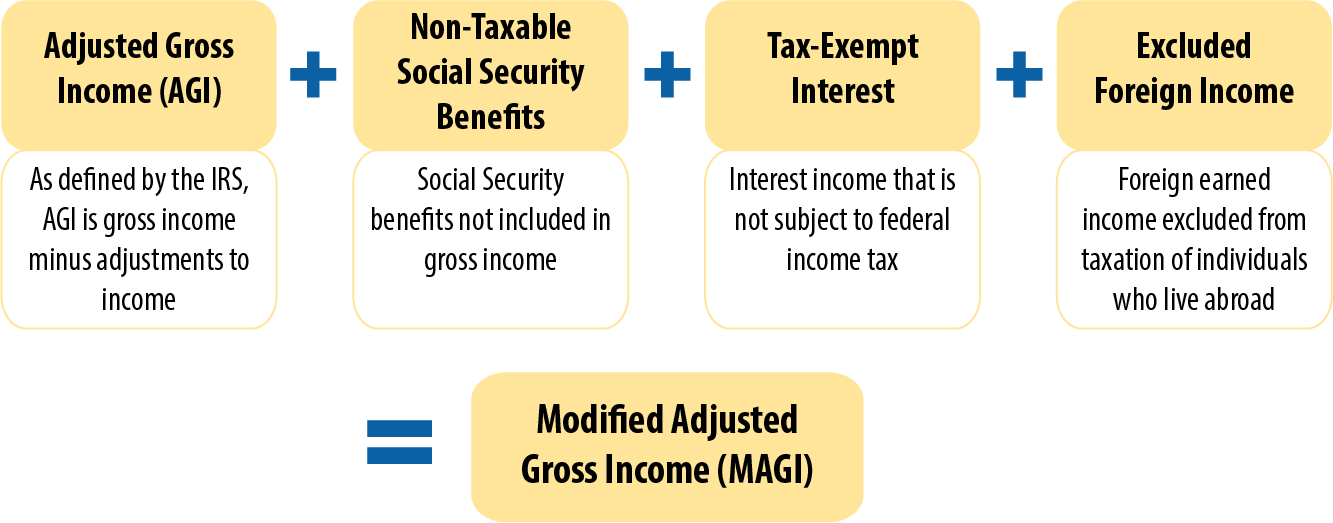

Income Definitions For Marketplace And Medicaid Coverage Beyond The Basics

Paycheck Taxes Federal State Local Withholding H R Block

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

What Are Income Taxes Napkin Finance

Federal Income Tax Brackets For The Year 2017 Exceldatapro

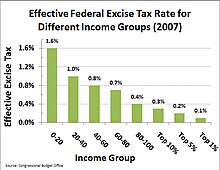

Excise Tax In The United States Wikipedia

What Is The Difference Between The Statutory And Effective Tax Rate

Does Your State S Individual Tax Code Conform With The Federal Code

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

Income Tax Definition What Are Income Taxes How Do They Work

Federal Income Tax Definition Rates Bracket Calculation

Taxes Congressional Budget Office

The Purpose And History Of Income Taxes St Louis Fed

Ultimate Excise Tax Guide Definition Examples State Vs Federal